what is an equity loan and how it works

Definition and basics

An equity loan is a secured loan that lets you borrow against the value you own in an asset, most commonly a home. Lenders calculate available equity by subtracting your mortgage balance from the property’s market value, then apply a lending limit. The result is a lump sum with a fixed rate and term, sometimes called a home equity loan.

How it works step by step

- Assess equity: Estimate value and current debt to gauge borrowing power.

- Apply: The lender reviews income, credit, and may order an appraisal.

- Receive funds: If approved, you get cash upfront and repay in installments.

- Repay: Fixed payments cover principal and interest over the set term.

Because the loan is secured, rates are often lower than unsecured credit, but the asset stands as collateral.

When it can make sense

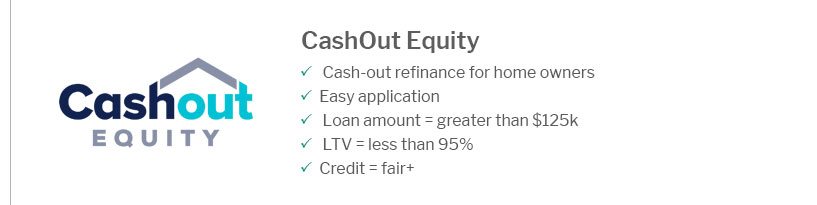

Used carefully, an equity loan can consolidate higher-interest debt, fund renovations that boost value, or cover major expenses with predictable payments. However, missed payments risk foreclosure; always compare total costs, fees, and alternatives like a HELOC or refinancing.